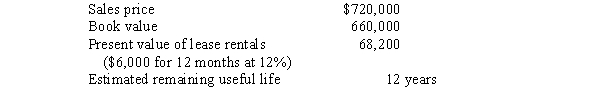

On December 31,2016,B Corp.sold a machine to Royal and simultaneously leased it back for one year.Pertinent information at this date follows:

In B's December 31,2016,balance sheet,the deferred revenue from the sale of this machine should be:

A) $ 0.

B) $ 8,200.

C) $60,000.

D) $68,200.

Correct Answer:

Verified

Q90: J Corp.entered into an operating lease in

Q91: C Corp.has a rate of return on

Q92: In a sale-leaseback arrangement,the lessee is also:

A)The

Q93: L Corp.recorded a capital lease in February

Q94: If the lessee and lessor use different

Q96: P Corp.leased an asset to L Corp.using

Q97: On December 31,2016,Perry Corporation leased equipment to

Q98: If the leaseback portion of a sale-leaseback

Q99: S Corp.has a rate of return on

Q100: Under both U.S.GAAP and IFRS,a lease is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents