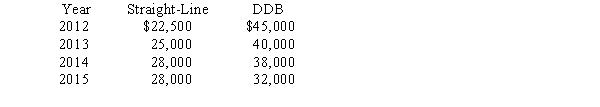

Weaver Textiles Inc.has used the straight-line method to depreciate its equipment since it started business in 2012.At the beginning of 2016,the company decided to change to the double-declining-balance (DDB)method.Depreciation as reported and as it would have been reported if the company had always used DDB is listed below:

Required:

What journal entry,if any,should Weaver make to record the effect of the accounting change (ignore income taxes)? Explain.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q97: Robertson Inc.prepares its financial statements according to

Q98: Listed below are five terms followed by

Q99: Canliss Mining uses the retirement method to

Q101: Compute depreciation for 2016 and 2017 and

Q103: On September 30,2016,Sternberg Company sold office equipment

Q104: Required:

Compute depreciation for 2016 and 2017 and

Q105: Required:

Compute depreciation for 2016 and 2017 and

Q106: Comet Cleaning Co.reported the following on its

Q107: Required:

Compute depreciation for 2016 and 2017 and

Q127: According to International Financial Reporting Standards (IFRS),

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents