Bloomington Inc.exchanged land for equipment and $3,000 in cash.The book value and the fair value of the land were $104,000 and $90,000,respectively.

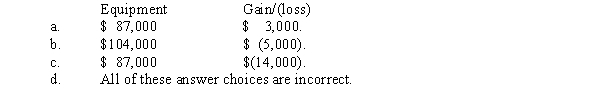

Bloomington would record equipment and a gain/(loss)of:

Correct Answer:

Verified

Q41: The basic principle used to value an

Q57: Assuming that the exchange has commercial substance,Alamos

Q58: P.Chang & Co.exchanged land and $9,000 cash

Q62: Use the following to answer questions

On

Q63: Average accumulated expenditures for 2017 was:

A)$ 536,000.

B)$1,236,000.

C)$1,200,000.

D)$1,036,000.

Q64: Interest may be capitalized:

A) On routinely manufactured

Q65: Use the following to answer questions

On

Q73: Interest is not capitalized for:

A) Assets that

Q75: The cost of self-constructed fixed assets should:

A)

Q96: Software development costs are capitalized if they

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents