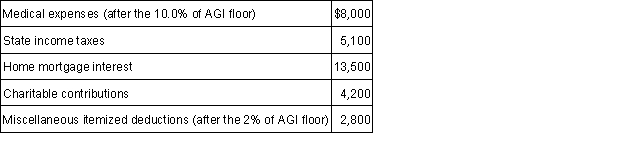

Cal reported the following itemized deductions on his 2015 tax return. His AGI for 2015 was $85,000. The mortgage interest is all qualified mortgage interest to purchase his personal residence. For AMT, compute his total itemized deductions.

A) $0.

B) $17,700.

C) $25,700.

D) $33,600.

Correct Answer:

Verified

Q45: For AMT purposes,a taxpayer must use which

Q46: AMT depreciation of personal property is calculated

Q55: Ferris owns an interest in, but does

Q56: Joshua purchased business furniture and fixtures (7-year

Q58: After computing all tax preferences and AMT

Q61: Elijah owns an apartment complex that he

Q62: In 2011, Lindsay's at-risk amount was $50,000

Q63: Jordan purchased a warehouse for $600,000. $100,000

Q64: Baird has four passive activities. The following

Q64: Terence and Alfred each invested $10,000 cash

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents