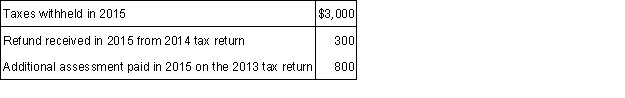

Cynthia lives in California, a state that imposes a tax on income. The following information relates to Cynthia's state income taxes for 2015:  Assuming she elects to deduct state and local income taxes, what amount should Cynthia use as an itemized deduction for state and local income taxes for her 2015 federal income tax return?

Assuming she elects to deduct state and local income taxes, what amount should Cynthia use as an itemized deduction for state and local income taxes for her 2015 federal income tax return?

A) $1,100.

B) $2,700.

C) $3,800.

D) $4,100.

Correct Answer:

Verified

Q43: Which of the following may not be

Q44: During 2015, Sam paid the following taxes:

Q45: For the current year, Sheila Jones had

Q46: During 2015 Shakira paid the following expenses:

Q47: Maria is single and age 32. In

Q49: Which of the following expenses is not

Q50: Which of the following costs are deductible

Q50: Mrs. Gonzales must use a wheelchair. Upon

Q52: For the current year, Sheila Jones had

Q53: Abel's car was completely destroyed in an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents