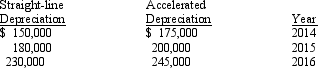

The Max Company began its operations on January 1, 2014, and used an accelerated method of depreciation for its machinery and equipment. On January 1, 2016, Max adopted the straight-line method of depreciation. The following information is available regarding depreciation expense for each method:

What is the before-tax cumulative effect on prior years' income that would be reported as of January 1, 2016, due to changing to a different depreciation method?

A) $0

B) a decrease of $45,000

C) an increase of $45,000

D) an increase of $60,000

Correct Answer:

Verified

Q7: When changing from LIFO to FIFO, the

Q11: A change in accounting principle from one

Q14: A change from LIFO to FIFO should

Q23: On January 1, 2014, Margo Company acquired

Q23: The Bronson Company changed its method of

Q24: When disclosing the impact of a retrospective

Q26: On January 1, 2014, Roy Company acquired

Q28: In cases where it is not practicable

Q36: Disadvantages of using the retrospective application method

Q39: If a company adopts a new accounting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents