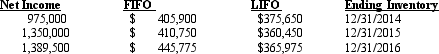

In 2016, Bevins Company decided to change from LIFO to FIFO due to better representation of the flow of inventory and costs. Bevins started the business in 2014. Bevin's tax rate is 35%. The following analysis was provided by management:  Required:

Required:

1) Prepare the journal entry necessary to record the change.

2) What amount of net income would Bevins report in 2014, 2015, and 2016?

Correct Answer:

Verified

Q80: On January 1, 2014, Tessa loaned

Q81: Exhibit 22-5

Daniel Company, having a fiscal

Q82: Exhibit 22-6 North Company has a fiscal

Q83: The correction of an error in the

Q86: Generally accepted accounting principles have identified four

Q87: Several items related to accounting changes appear

Q88: The Opal Company was incorporated and began

Q89: The following are independent events:

Q90: Exceptions exist in the retrospective restatement requirements

Q100: A change to GAAP from a principle

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents