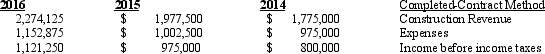

Shelley Construction began operations in 2014 and appropriately used the completed-contract method in accounting for its long-term construction contracts. The prepared the following information:

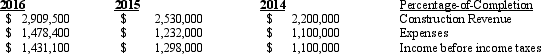

Effective January 1, 2016, Shelley changed to the percentage-of-completion method tax reporting and can justify the change; the company's tax rate is 35%. It determines the construction and revenue expense amounts under the percentage of completion method to be:

Required:

1) How would the company account for the change?

2) Prepare the journal entries to reflect the changes.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: Most changes in accounting principles are accounted

Q113: On January 1, 2014, Suzanne Company purchased

Q114: The Laura Company has the following errors

Q114: What are the three type of accounting

Q116: On January 1, 2014, Sarah Company purchased

Q117: ......

Q117: Provide three examples of changes in principle.

Q120: The 2014 and 2015 financial statements for

Q121: Current GAAP defines three types of changes:

Q125: What differences exist between U.S. GAAP and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents