The Donna Company adopted a defined benefit pension plan on January 1, 2014, and prior service credit was granted to employees. As of January 1, 2014, the prior service cost is $68,250. The unrecognized prior service cost is amortized by the straight-line method over the remaining 15-year service life of the company's active employees. Funding for the pension plan was $170,745 and $186,933 at December 31, 2014 and 2015, respectively.

Required:

Prepare the journal entries to record net periodic pension expense and the funding as of December 31, 2014 and 2015. Show computations and round answers to the nearest dollar.

Correct Answer:

Verified

Q61: Which of the following is typically the

Q68: Which of the following disclosures are required

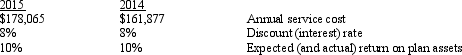

Q69: The following information is provided regarding a

Q70: On December 31, 2014, Clemson Company determined

Q71: Joan, Inc. started a pension plan on

Q72: Postemployment benefits are provided to former employees

A)

Q74: Teresa Company had the following information related

Q76: A list of terms (a-i) and a

Q77: Mark, Inc. amended its defined benefit pension

Q78: Robin Co. has a defined benefit pension

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents