Jennifer Corp's defined benefit pension plan had an amendment as of January 1, 2014, that retroactively included benefits of $1,500,000. The remaining service life of the employees impacted by this change is 10 years. Jennifer uses the straight-line method to amortize the prior service cost.

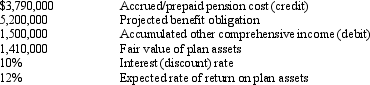

As of January 1, 2014, Jennifer had the following information related to its pension plan, including adjustments for the plan amendment:

The actuary reported service cost of $600,000 in both 2014 and 2015. Annual payments to retirees totaled $90,000. The trustee of the plan assets reported the actual rate of return to be 11% in 2014.

Jennifer's annul year-end contribution to the plan equals the current year's service cost less actual return on plan assets plus interest growth of the projected benefit obligation and amortization of prior service costs and/or gains and losses as calculated for pension expense.

Required:

a.Compute Jennifer's 2014 contribution.

b.Compute Jennifer's 2014 pension expense.

c.Prepare the journal entry to record the pension expense and pension contribution.

d.Compute the December 31, 2014 balance in Pension Benefit Obligation.

e.Compute the December 31, 2014 balance in Plan Assets.

f.Prepare the adjusting journal entry to record the plan's adjustment to other comprehensive income at December 31, 2014.

g.Is Jennifer's plan overfunded or underfunded, and by how much, as of December 31, 2014?

Correct Answer:

Verified

g.

The plan is underfunded by $3,640,0...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: Which of the following is typically the

Q62: The attribution period ends at

A) the expected

Q63: During 2013, the Electric Company experienced a

Q64: In 2014, the Electrician Company decided to

Q65: The following information is related to a

Q66: In 2014, the Ballaster Company decided to

Q68: Which of the following disclosures are required

Q69: The following information is provided regarding a

Q70: On December 31, 2014, Clemson Company determined

Q71: Joan, Inc. started a pension plan on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents