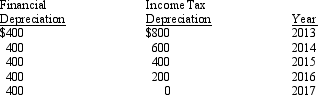

Pruett Corporation began operations in 2013 and appropriately recorded a deferred tax liability at the end of 2013 and 2014 based on the following depreciation temporary differences between pretax financial income and taxable income:

The income tax rate for 2013 and 2014 was 30%. In February 2015, due to budget constraints, Congress enacted an income tax rate of 35%. The journal entry required to adjust the Deferred Tax Liability account in February 2015 would be

A) Loss on Adjustment of Deferred Taxes 30

Deferred Tax Liability 30

B) Deferred Tax Liability 30

Gain on Change in Tax Rates 30

C) Income Tax Expense 10

Deferred Tax Liability 10

D) Income Tax Expense 30

Deferred Tax Liability 30

Correct Answer:

Verified

Q7: Each of the following can result in

Q15: When Congress changes the tax laws or

Q21: All of the following involve a temporary

Q29: During its first year of operations,

Q30: As of December 31, 2014, the Williamsburg

Q31: Temporary differences arise when revenues or gains

Q32: Exhibit 18-1 On December 31, 2013, Fredericksburg,

Q33: Temporary differences arise when expenses or losses

Q38: In 2014, its first year of operations,

Q39: Exhibit 18-1 On December 31, 2013, Fredericksburg,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents