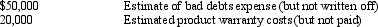

The Flintstone Company incurred the following expenses in 2014, which are reported differently for financial reporting purposes and taxable income:

If the tax rate is 40%, the total temporary difference is

A) $ 20,000

B) $ 28,000

C) $ 70,000

D) $150,000

Correct Answer:

Verified

Q13: Which of the following would not result

Q29: Permanent differences impact

A)current deferred taxes

B)current tax liabilities

C)deferred

Q42: The Pink Diamonds Company installs fire alarm

Q43: Lewes Company appropriately uses the installment sales

Q46: At the end of its first

Q48: During its first year of operations ending

Q49: On January 1, 2014, Bedrock Company began

Q50: Which one of the following requires interperiod

Q52: When accounting for the current impact of

Q53: Which one of the following statements regarding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents