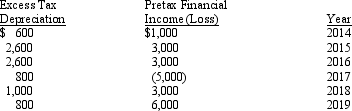

Rice, Inc. began operations on January 1, 2014. Depreciation temporary differences were the only differences between pretax financial income (loss) and taxable income (loss) in any year. The income tax rate was 35% in each year and no changes in income tax rates were expected. Pretax financial income (loss) and the temporary differences due to depreciation were as follows:

Required:

Prepare the income tax journal entry for Rice, Inc. for December 31, 2017; assuming no valuation allowance is required for Rice's deferred tax assets.

Correct Answer:

Verified

Q92: Lakeland Corporation reported the following pretax (and

Q93: What two issues does FASB have to

Q94: At the beginning of 2014, Jasper Company

Q95: In order to implement FASB's objectives what

Q96: At the end of its first year

Q98: What two objectives did FASB identify for

Q99: Rehobeth Company's taxable income and other financial

Q100: At the end of the current year,

Q102: Identify the three essential characteristics of an

Q107: What is intraperiod tax allocation?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents