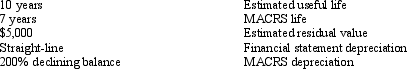

On January 1, 2013, Smith-Jones Company purchased office furniture for $80,000. Other data on the purchase include the following:

Required: a.Compute the depreciation deduction for the 2013 tax return.

b.Assume the asset is sold on April 1, 2021 for $3,000. Compute the gain/loss on disposal for both financial reporting and tax reporting.

Correct Answer:

Verified

Q102: When accounting for long-lived assets, companies may

Q113: Jonas Company purchased a photocopier that cost

Q122: Companies can apply composite depreciation to a

Q122: Information concerning a mine is as follows:

Q124: On January 1, 2013, the Jones-Smith Corp.

Q128: Making intercompany comparisions is equally as important

Q129: On January 1, 2014 Hill Bowling purchased

Q130: On April 1, 2014, an uninsured machine

Q131: On January 1, 2014, Travis Company purchased

Q135: In what three respects does the computation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents