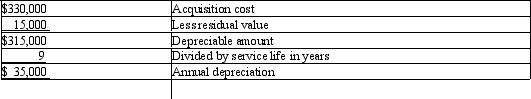

On July 1st, Harding Construction purchases a bulldozer for $330,000. The equipment has a 9 year life with a residual value of $15,000. Harding uses straight-line depreciation.

(a) Calculate the depreciation expense and provide the journal entry for the first year ending December 31st.

(b) Calculate the third year's depreciation expense and provide the journal entry for the third year ending December 31st.

(c) Calculate the last year's depreciation expense and provide the journal entry for the last year.

Annual depreciation is:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q150: Golden Sales has bought $135,000 in fixed

Q165: A copy machine acquired with a cost

Q166: On July 1, 2010, Howard Co. acquired

Q167: Computer equipment (office equipment) purchased 6 1/2

Q168: Machinery acquired at a cost of $80,000

Q170: Clanton Company engaged in the following transactions

Q172: Equipment acquired at a cost of $126,000

Q173: Eagle Country Club has acquired a lot

Q174: On December 31 it was estimated that

Q175: Prepare the following journal entries and calculations:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents