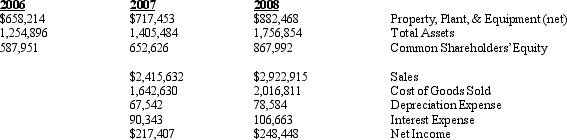

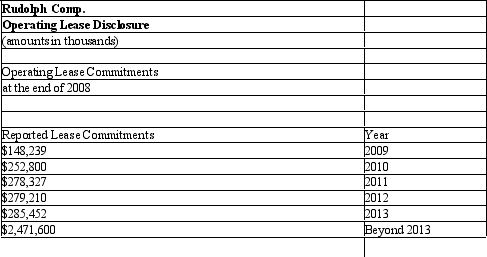

NOTE: These multiple choice questions require present value information. Rudolph Corporation manufactures Christmas decorations and supplies throughout the world. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. Assume that Randolph's incremental borrowing rate is 8%. The company's tax rate is 40%. Listed below is selected financial data for Rudolph and a portion of the company's operating lease footnote.

Assuming that Rudolph Corporation was required to capitalize its operating lease how would the company's fixed asset ratio change under this assumption.

Assuming that Rudolph Corporation was required to capitalize its operating lease how would the company's fixed asset ratio change under this assumption.

A) increase

B) decrease

C) no effect

D) unable to determine

Correct Answer:

Verified

Q9: Which of the following calculations is used

Q28: The lessor in a capital lease recognizes

Q34: The _ is equal to the actuarial

Q36: NOTE: The following multiple choice questions require

Q41: Under an operating lease agreement the lessee

Q41: _ differences result from including revenues and

Q49: A derivative has one or more _,which

Q54: A security that has both equity and

Q55: Derivative instruments acquired to hedge exposure to

Q56: Income tax expense consists of two components,the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents