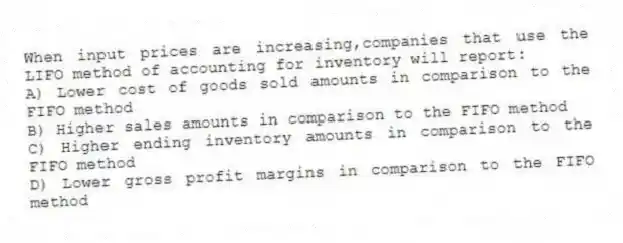

When input prices are increasing,companies that use the LIFO method of accounting for inventory will report:

A) Lower cost of goods sold amounts in comparison to the FIFO method

B) Higher sales amounts in comparison to the FIFO method

C) Higher ending inventory amounts in comparison to the FIFO method

D) Lower gross profit margins in comparison to the FIFO method

Correct Answer:

Verified

Q18: A minimum liability for pension expense is

Q19: All of the following are conditions for

Q20: Which of the following accounts would not

Q21: A LIFO liquidation during periods when prices

Q22: Which of the following is not part

Q24: Typical U.S.GAAP disclosures for deferred income taxes

Q25: Dividing a company's income tax expense by

Q26: All of the following examples represent complex

Q27: Deferred tax assets result in future tax

Q28: All of the following are most likely

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents