Parson Services Corporation was organized on January 1, Year 8.The unadjusted trial balance on December 31, Year 8 after recording transactions that occurred during Year 8 is as follows.

Parson Services Corporation

Unadjusted Trial Balance

December 31 , Year 8

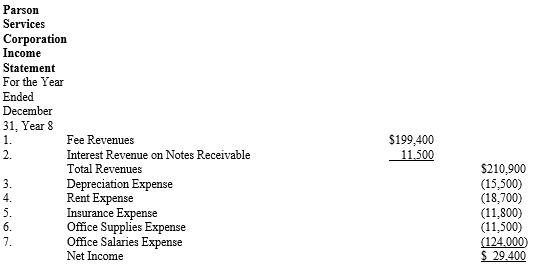

Below is the income statement for Year 8 that was prepared after making appropriate adjusting entries for Year 8.

Required:

Required:

Give the adjusting entries that Parson Services Corporation must have made at the end of Year 8 for each of the seven income statement accounts.You may express the adjusting entries either in the form of journal entries or T accounts.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q108: Solve for the unknown item for

Q109: Assume that a firm uses the accrual

Q110: The net income for a period and

Q111: The closing process involve(s):

A)reducing to zero the

Q112: Humana Corporation neglected to make various adjusting

Q114: The result of closing entries is that

Q115: The accounting records for Pocket's Restaurant

Q116: Certain merchandise that a firm may acquire

Q117: Before preparing the balance sheet and income

Q118: The _ are linked (that is, they

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents