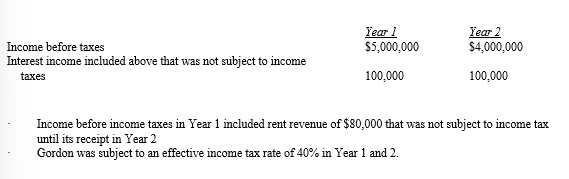

Information relating to Gordon Corporation for Year 1 and Year 2 is as follows: (CMA adapted, Jun 86 #7) Refer to the Gordon Corporation example.The amount of current income tax expense that would have been reported on Gordon Corporation's Income Statement for the year ended December 31, Year 1 is

(CMA adapted, Jun 86 #7) Refer to the Gordon Corporation example.The amount of current income tax expense that would have been reported on Gordon Corporation's Income Statement for the year ended December 31, Year 1 is

A) $1,928,000

B) $1,960,000

C) $1,980,000

D) $1,992,000

E) $2,000,000

Correct Answer:

Verified

Q93: U.S.GAAP and IFRS require complex procedures in

Q94: Notes to the financial statements provide additional

Q95: U.S.GAAP and IFRS require complex procedures in

Q96: Information relating to Gordon Corporation for

Q97: Notes to the financial statements provide additional

Q99: In any given accounting period, the amount

Q100: Acquired in-process research and development (IPR&D) is

Q101: Barry Company grows and ages tobacco. On

Q102: Garvin, a consumer foods company reports the

Q103: Discuss the accounting for income taxes and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents