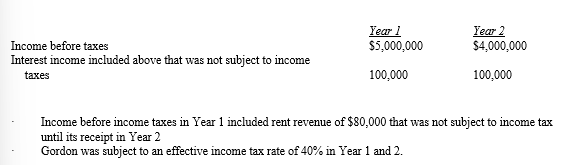

Information relating to Gordon Corporation for Year 1 and Year 2 is as follows: (CMA adapted, Jun 86 #10) Refer to the Gordon Corporation example.The amount of deferred income taxes that would have been reported on Gordon Corporation's Statement of Financial Position on December 31, Year 2, is

(CMA adapted, Jun 86 #10) Refer to the Gordon Corporation example.The amount of deferred income taxes that would have been reported on Gordon Corporation's Statement of Financial Position on December 31, Year 2, is

A) $40,000

B) $32,000

C) $16,000

D) $8,000

E) zero

Correct Answer:

Verified

Q77: Both the regulatory treatment and the tax

Q78: Taxable income excludes _ and uses the

Q79: Income tax expense affects assessments of profitability

Q80: Which of the following is not true

Q81: Do firms confront ethical issues when engaging

Q83: Firms recognize deferred tax assets only to

Q84: In any given accounting period, the amount

Q85: In any given accounting period, the amount

Q86: Deferred Tax Asset or Deferred Tax Liability

Q87: Firms recognize deferred tax assets only to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents