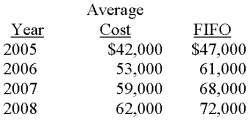

Orlando Company has used the average cost method for inventory valuation since it began business in 2005, but has elected to change to the FIFO method starting in 2008. Year-end inventory valuations under each method are shown below:

Required:

What journal entry, if any, would Orlando record in 2008 for the cumulative effect of the change in accounting principle (ignore income taxes)?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q90: Cindy Lou Linens uses the conventional

Q91: Manila Bread Company uses the average

Q92: DK Super Stores Inc. uses the

Q93: Cornhusker Can Co. uses the conventional

Q94: Billingsly Products uses the conventional retail

Q96: New York Sales Inc. uses the

Q97: Harley Inc. uses the conventional retail

Q98: In the following questions, inventory

Q99: In the following questions, inventory

Q100: Andover Stores uses the average cost

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents