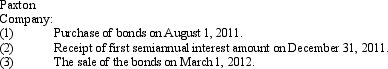

On August 1, 2011, Airport Company sold Paxton Company $1,000,000 of 10-year, 6% bonds, dated July 1 at 100 plus accrued interest. On March 1, 2012, Paxton sold half of the bonds for $520,000 plus accrued interest. Present entries to record the following transactions:

Correct Answer:

Verified

Q96: All of the following are disadvantages of

Q98: The account Unrealized Gain (Loss) on Available-For-Sale

Q99: The account Unrealized Gain (Loss) on Trading

Q100: On January 1, 2014, Blanton Company's Valuation

Q102: Albright Company purchased as a long-term investment

Q103: The income statement for Hudson Company reported

Q104: Define (1) debt securities and (2) equity

Q105: Journalize the entries to record the following

Q106: On May 1, 2015, Chase Inc. purchases

Q118: Edison Corporation paid a dividend of $10

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents