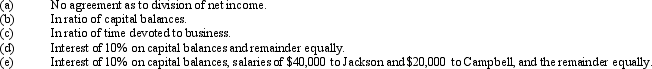

Jackson and Campbell have capital balances of $100,000 and $300,000 respectively. Jackson devotes full time and Campbell one-half time to the business. Determine the division of $120,000 of net income under each of the following assumptions:

Correct Answer:

Verified

Q161: What is a partnership? List three advantages

Q180: Prior to liquidating their partnership, Porter and

Q181: After discontinuing the ordinary business operations and

Q182: Jackson and Campbell have capital balances of

Q184: Immediately prior to the process of liquidation,

Q186: Derek and Hailey, partners sharing net income

Q187: Describe the items which should be covered

Q188: Kala and Leah, partners in Best Designs,

Q189: Watson purchased one-half of Dalton's interest in

Q190: Wonder purchased one-half of Darwin's interest in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents