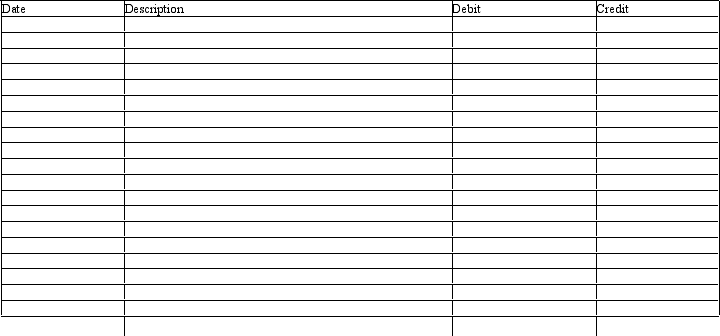

Clanton Company engaged in the following transactions during 2011. Record each in the general journal below:

1) On January 3, 2011, Clanton purchased a copyright from Dalton Company with a cost of $250,000 with a remaining useful life of 25 years.

2) On January 10, 2011, Clanton purchased a trademark from Felton Company with a cost of $700,000.

3) On July 1, 2011, Clanton purchased a patent from Garrison Company at a cost of $80,000. The remaining legal life of the patent is 15 years and the expected useful life is 11 years.

4) On July 2, 2011, Clanton paid $30,000 in legal fees to defend the patent protection purchased on July 1, 2011.

5) Recorded the appropriate amortization for the intangible assets for 2011.

6) Clanton Company includes an asset in its ledger recorded when Clanton purchased a computer service business at a price in excess of the fair value of the assets of the company in the amount of $400,000. At December 31, 2011, $100,000 of this asset has become impaired.

Correct Answer:

Verified

Q160: Machinery is purchased on July 1 of

Q161: On July 1, 2010, Howard Co. acquired

Q162: Macon Co. acquired drilling rights for $7,500,000.

Q163: Machinery acquired at a cost of $80,000

Q164: Equipment acquired at a cost of $126,000

Q165: A copy machine acquired on March 1,

Q167: Computer equipment (office equipment) purchased 6 1/2

Q168: A copy machine acquired on March 1,

Q169: On December 31 it was estimated that

Q170: Prepare the following journal entries and calculations:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents