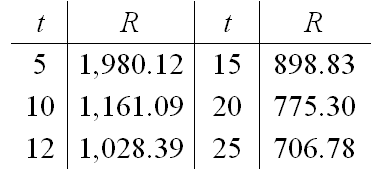

When a debt is refinanced, sometimes the term of the loan (that is, the time it takes to repay the debt) is shortened. Suppose the current interest rate is 7%, and the current debt is $100,000. The monthly payment R of the refinanced debt is a function of the term of the loan t in years. If we represent this function by  , then the following table defines the function.

, then the following table defines the function.

Source: Comprehensive Mortgage Payment Tables, Publication No. 492, Financial Publishing Co., Boston

Choose the correct verbal description of  .

.

A) From the table,  the value of

the value of  is the yearly payment to repay a $100,000 loan in 12 years when the interest rate is 7%.

is the yearly payment to repay a $100,000 loan in 12 years when the interest rate is 7%.

B) From the table,  the value of

the value of  is the monthly payment to repay half of a $100,000 loan in 12 years when the interest rate is 7%.

is the monthly payment to repay half of a $100,000 loan in 12 years when the interest rate is 7%.

C) From the table,  the value of

the value of  is the weekly payment to repay a $100,000 loan in 12 years when the interest rate is 7%.

is the weekly payment to repay a $100,000 loan in 12 years when the interest rate is 7%.

D) From the table,  the value of

the value of  is the monthly payment to repay a $100,000 loan in 12 years when the interest rate is 7%.

is the monthly payment to repay a $100,000 loan in 12 years when the interest rate is 7%.

E) From the table,  the value of

the value of  is the monthly payment to repay a $100,000 loan in 12 years when the interest rate is 7%.

is the monthly payment to repay a $100,000 loan in 12 years when the interest rate is 7%.

Correct Answer:

Verified

Q66: For Q67: For Q68: If Q69: A function and its graph are given. Q70: For Q72: A function and its graph are given. Q73: A couple seeking to buy a home Q74: If t represents the number of hours Q75: Suppose Q76: For Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()

![]()

![]()

![]()