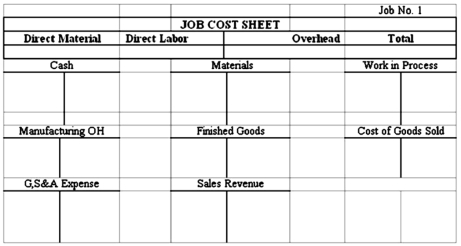

Burton Company custom-produces specialty souvenir products. During the current accounting period, the company completed the following transactions:

(a) Purchased $20,000 of raw materials, paying cash.(b) Used direct materials in production as follows:

(c) Paid direct labor costs as follows:

(d) Paid cash for various actual factory overhead costs, $40,000.(e) Applied factory overhead to production using a predetermined overhead rate of $1.50 per direct labor dollar.(f) Completed Job 1.(g) Job 1 was sold for $50,000 cash.(h) Paid $1,000 for selling and administrative expenses.Required:

1) Record the data in the T-accounts provided. Post costs to the job cost sheet for Job 1 as necessary.Label the transactions (a) - (h).2) As transaction (i) post the closing entry for any underapplied or overapplied overhead assuming that the amount is written off directly against cost of goods sold.3) Prepare a schedule of cost of goods manufactured and sold assuming there were no beginning inventories.4) Compute the amount of gross profit earned on Job 1.

Correct Answer:

Verified

2) Posted T...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q122: Indicate whether each of the following statements

Q131: Mertz Group is a consulting firm specializing

Q136: Indicate whether each of the following statements

Q137: Indicate whether each of the following statements

Q138: Select the response from the list provided

Q141: Ling Company has two departments, assembly and

Q142: For the month of November, Department

Q143: Bacon Manufacturing Company has two departments, Assembly

Q144: In April, the Assembly Department's beginning work

Q145: Jiminez Company engaged in the following transactions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents