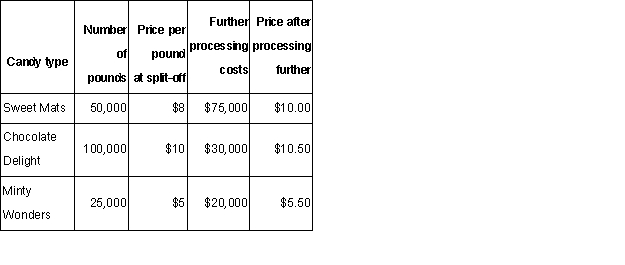

Delite Confectionary Company produces various types of candies.Several candies could be sold at the split-off point or processed further and sold in a different form after further processing.The candies are produced in a joint processing operation with $500,000 of joint processing costs monthly,which are allocated based on pounds produced.Information concerning this process for a recent month appears below:  The joint processing costs in this operation:

The joint processing costs in this operation:

A) should be allocated to products to determine whether they are sold at split-off or processed further.

B) should be ignored in determining whether to sell at split-off or process further.

C) should be ignored in making all product decisions.

D) are never included in product cost,as they are misleading to all management decisions.

Correct Answer:

Verified

Q90: Upton Company produces two main products and

Q91: Cariboo Manufacturing Company incurred a joint

Q92: The Foxmoor Company produces three products,X,Y,and Z

Q93: Atkinson,Inc. ,manufactures products A,B,and C from a

Q94: Tanner Corporation produced 3,660 units,consisting of three

Q96: In joint product costing and analysis,which one

Q97: Delite Confectionary Company produces various types of

Q98: The Mallak Company produced three joint

Q99: Atkinson,Inc. ,manufactures products A,B,and C from a

Q100: Cambridge Company manufactures three main products,L,M,and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents