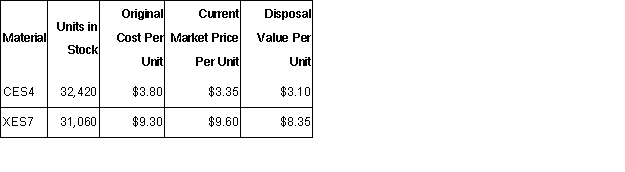

Lafferty Corporation is a specialty component manufacturer with idle capacity.Management would like to use its unused capacity to generate additional profits.A potential customer has offered to buy 6,200 units of component Rocket.Each unit of Rocket requires 8 units of material CES4 and 6 units of material XES7.Data concerning these two materials follow:

Material CES4 is in use in many of the company's products and is routinely replenished.

Material XES7 is no longer used by the company in any of its normal products and existing stocks would not be replenished once they are used up.

What would be the relevant cost of the materials,in total,for purposes of determining a minimum acceptable price for the order for product Rocket? (CIMA adapted)

A) $528,551.

B) $523,280.

C) $476,350.

D) $484,455.

Correct Answer:

Verified

Q18: The full cost fallacy occurs when a

Q19: In the short-run,plant capacity is fixed and

Q20: If there is only one alternative course

Q22: The price based on customers' perceived value

Q26: Which of the following costs are not

Q26: The period of time over which capacity

Q27: In a decision analysis situation, which one

Q27: Starla Corporation is a specialty component

Q33: The Crispy Baking Company is considering the

Q39: Differential costs are: (CMA adapted)

A) the difference

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents