The following information is available for Parsons Corporation, which uses the allowance method of accounting for uncollectible accounts.

Parsons expects 1% of sales on account to be uncollectible.

Required:

a) What is the balance of Accounts Receivable at the end of 2014?

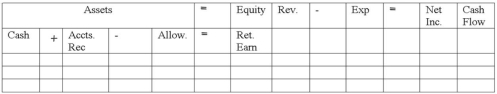

b) What is the amount of uncollectible accounts expense for 2014? Use the financial statements model below to indicate the effect of recording uncollectible accounts expense. Include dollar amounts of increases and decreases.

c) In 2015, after several attempts of collection, Parsons wrote off accounts that could not be collected in the amount of $300. Use the financial statements model that is provided to indicate the effect of the write-off on the financial statements, indicating amounts of increases and decreases.

d) Later in 2015, Erin received a check for $50 from one of the customers whose account had been written off in (c) above. Use the financial statements model to indicate the effect of the collection of the $50 on the financial statements, indicating amounts of increases and decreases.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Define the terms FIFO and LIFO.

Q125: After the accounts are adjusted at the

Q126: In an inflationary period, which cost flow

Q127: Guerrero Company engaged in the following events

Q128: An aging of Sernett Company's accounts receivable

Q129: In an inflationary period, which inventory cost

Q132: A promissory note involves a maker, payee,

Q133: A company that has a note receivable

Q134: In relation to inventory, differentiate between flow

Q135: Haven Company began 2014 with a balance

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents