On January 1, 2010, Jones Company bought 15% of Whitton Company. Jones paid $150,000 for these shares, an amount that exactly equaled the proportionate book value of Whitton. On January 1, 2011, Whitton acquired 80% ownership of Jones. The following data are available concerning Whitton's acquisition of Jones:

Consideration transferred for 80% interest, January 1, 2011: $800,000

Jones' reported book value, January 1, 2011: 900,000

Excess fair value over book value (assigned to trademarks) is amortized over 20 years.

The initial value method is used by both companies.

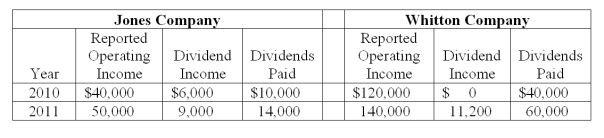

The following information is available regarding Jones and Whitton:

-Compute the noncontrolling interest in net income for 2011.

A) $11,000.

B) $10,800.

C) $9,000.

D) $8,200.

E) $7,200.

Correct Answer:

Verified

Q7: Q10: What is this pattern of ownership called? Q18: River Co. owned 80% of Boat Inc. Q20: What amount of dividends did West Corp. Q23: On January 1, 2010, Jones Company bought Q25: On January 1, 2010, Jones Company bought Q26: Chase Company owns 80% of Lawrence Company Q29: The benefits of filing a consolidated tax Q29: Which of the following statements is true Q38: When indirect control is present, which of![]()

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents