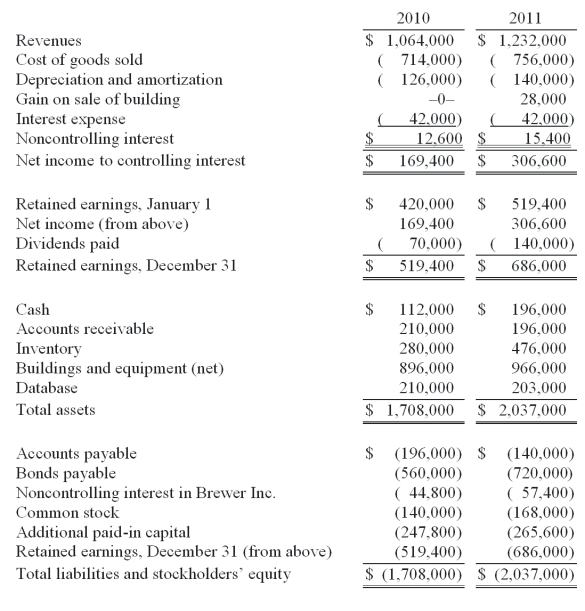

Allen Co. held 80% of the common stock of Brewer Inc. and 40% of this subsidiary's convertible bonds. The following consolidated financial statements were for 2010 and 2011.

Additional Information:

Bonds were issued during 2011 by the parent for cash.

Amortization of a database acquired in the original combination amounted to $7,000 per year.

A building with a cost of $84,000 but a $42,000 book value was sold by the parent for cash on May 11, 2011.

Equipment was purchased by the subsidiary on July 23, 2011, using cash.

Late in November 2011, the parent issued common stock for cash.

During 2011, the subsidiary paid dividends of $14,000.

Required:

Prepare a consolidated statement of cash flows for this business combination for the year ending December 31, 2011. Either the direct method or the indirect method may be used.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q100: Fargus Corporation owned 51% of the voting

Q101: Skipen Corp. had the following stockholders'

Q103: Prepare all consolidation entries for 2011.

Q103: Describe how this transaction would affect Panton's

Q104: Fargus Corporation owned 51% of the voting

Q106: Fargus Corporation owned 51% of the voting

Q106: Prepare Panton's journal entry to recognize the

Q106: Prepare Panton's journal entry to recognize the

Q107: Thomas Inc. had the following stockholders'

Q109: Jet Corp. acquired all of the outstanding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents