Figure:

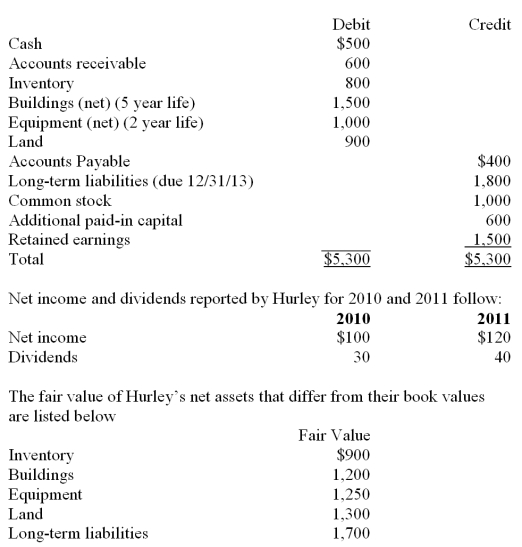

Perry Company acquires 100% of the stock of Hurley Corporation on January 1, 2010, for $3,800 cash. As of that date Hurley has the following trial balance;  Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life. FIFO inventory valuation method is used.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life. FIFO inventory valuation method is used.

-Compute the amount of total expenses reported in an income statement for the year ended December 31, 2010, in order to recognize acquisition-date allocations of fair value and book value differences,

A) $140.

B) $190.

C) $260.

D) $285.

E) $310.

Correct Answer:

Verified

Q44: Figure:

Perry Company acquires 100% of the stock

Q45: Figure:

Following are selected accounts for Green

Q46: Kaye Company acquired 100% of Fiore Company

Q47: Figure:

Perry Company acquires 100% of the stock

Q48: Figure:

Following are selected accounts for Green

Q50: Figure:

Following are selected accounts for Green

Q51: Figure:

Following are selected accounts for Green

Q52: Figure:

Perry Company acquires 100% of the stock

Q53: Figure:

Perry Company acquires 100% of the stock

Q54: Figure:

Perry Company acquires 100% of the stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents