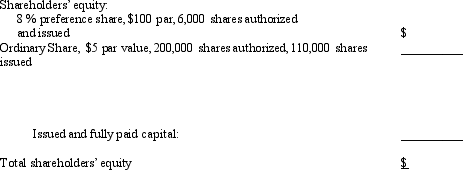

Prepare a shareholders' equity section.

When Haven Corporation was incorporated in 2009, authorization was obtained to issue 200,000 $5 par value ordinary share and 6,000 8% non-cumulative preference share. The preference share has a par value of $100. All the preference share was issued at $107 per share, and 110,000 ordinary shares were sold for $9 per share. The operations of the company resulted in a net loss of $19,000 in 2009 and profit of $125,000 in 2010. In 2011, profit was $352,000, and the cash position was sufficient to allow the board of directors to declare a cash dividend of $1 per share to the ordinary shareholders, as well as satisfy all preference share dividend requirements.

Complete in good form the shareholders' equity section of Haven Corporation's balance sheet at December 31, 2011. (Hint: First determine the total amount of dividends declared in 2011.)

Correct Answer:

Verified

($19,000) + $125,...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q121: Cash dividends and two classes of share.

Raymond

Q122: Prepare the shareholders' equity section from

Q123: Book value per share and other

Q124: Interpreting the shareholders' equity section.

The shareholders'

Q125: Accounting terminology.

Listed below are nine technical

Q127: Financial reporting of losses and retained earnings.

A

Q128: Share splits.

Bainbridge Corporation recently patented an extraordinary

Q129: Share values.

Presented below is an excerpt

Q130: What's so "preference" about preference shares?

Most preference

Q131: Factors affecting the market price of shares.

(a)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents