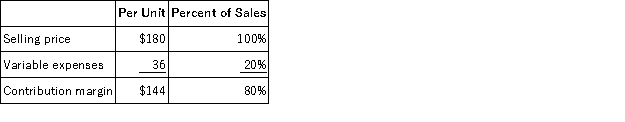

Salley Corporation produces and sells a single product. Data concerning that product appear below:  Fixed expenses are $1,133,000 per month. The company is currently selling 9,000 units per month. Management is considering using a new component that would increase the unit variable cost by $7. Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 500 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $1,133,000 per month. The company is currently selling 9,000 units per month. Management is considering using a new component that would increase the unit variable cost by $7. Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 500 units. What should be the overall effect on the company's monthly net operating income of this change?

A) decrease of $68,500

B) decrease of $5,500

C) increase of $68,500

D) increase of $5,500

Correct Answer:

Verified

Q41: Solen Corporation's break-even-point in sales is $900,000,

Q42: The Clyde Corporation's variable expenses are 35%

Q45: Last year Easton Corporation reported sales of

Q46: Carlton Corporation sells a single product at

Q47: Darwin Inc. sells a particular textbook for

Q52: Arthur Corporation has a margin of safety

Q53: Data concerning Bunck Corporation's single product appear

Q55: Garcia Veterinary Clinic expects the following operating

Q57: Lore Corporation has provided the following information:

Q58: Joly Corporation produces and sells a single

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents