Baker, Inc. produces a number of components that are used in home theater systems. Fred Briggs, head of the company's market research department, has identified the need for a new component that will most likely sell for $75. Projected volume levels are anticipated to reach 28,000 units in the first year, as several firmly entrenched competitors will be introducing a similar product in the not-too-distant future.

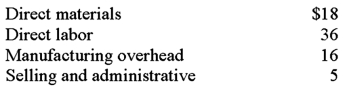

Conversations with Baker's engineers and reviews of cost accounting data related to similar products that the company manufactures resulted in the following cost estimates for the new component:

Baker currently uses cost-plus pricing and adds a 20% markup on total production cost to arrive at what is normally a competitive selling price.

Required:

A. What is the anticipated selling price of the new component if Baker uses its current pricing policy? What difficulties, if any, might the company face in the marketplace?

B. Assume that Baker decides to switch to target costing. What price would the company charge for the new component?

C. With the switch to target costing, what would Baker have to do to the component's manufacturing cost to achieve the normal profit margin on sales? Be specific and show calculations.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q65: Consider the following statements about competitive bidding:

I.

Q72: Which of the following cost-reduction and process-improvement

Q76: Under the time and material pricing

Q77: Overland Shipping Company is involved in

Q80: Goldman Corporation uses time and material pricing.

Q82: Hershey, Inc. sells a single product. The

Q83: Wardlaw Company, which experiences considerable seasonal variation

Q84: Voltage Electrical, which installs sophisticated electronic-control

Q85: High's Roofing performs roofing services for

Q86: Morrow Corporation manufactures part no. 67,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents