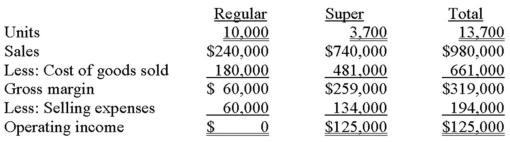

HiTech manufactures two products: Regular and Super. The results of operations for 20x1 follow.  Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed.

Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed.

HiTech wants to drop the Regular product line. If the line is dropped, company-wide fixed manufacturing costs would fall by 10% because there is no alternative use of the facilities. What would be the impact on operating income if Regular is discontinued?

A) $0.

B) $10,400 increase.

C) $20,000 increase.

D) $39,600 decrease.

E) None of the other answers are correct.

Correct Answer:

Verified

Q45: When deciding whether to sell a product

Q50: Occular is studying whether to drop a

Q51: HiTech manufactures two products: Regular and Super.

Q52: The Shoe Department at the El

Q52: An architecture firm currently offers services that

Q56: Laredo manufactures Nuts and Bolts from a

Q57: Coastal Airlines has a significant presence at

Q58: Summers Corporation is composed of five

Q63: Product costs incurred before the split-off point

Q68: A company that is operating at full

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents