Dancer Corporation, which uses a job-costing system, had two jobs in process at the start of 20x1: job no. 59 ($95,000) and job no. 60 ($39,500). The following information is available:

• The company applies manufacturing overhead on the basis of machine hours. Budgeted overhead and machine activity for the year were anticipated to be $720,000 and 20,000 hours, respectively.

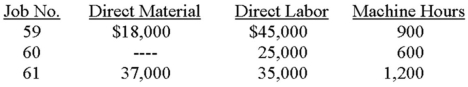

• The company worked on three jobs during the first quarter. Direct materials used, direct labor incurred, and machine hours consumed were:

• Manufacturing overhead during the first quarter included charges for depreciation ($20,000), indirect labor ($50,000), indirect materials used ($4,000), and other factory costs ($108,700).

• Dancer completed job no. 59 and job no. 60. Job no. 59 was sold for cash, producing a gross profit of $24,600 for the firm.

Required:

A. Determine the company's predetermined overhead application rate.

B. Prepare journal entries as of March 31 to record the following. (Note: Use summary entries where appropriate by combining individual job data.)

1. The issuance of direct material to production, and the direct labor incurred.

2. The manufacturing overhead incurred during the quarter.

3. The application of manufacturing overhead to production.

4. The completion of job no. 59 and no. 60.

5. The sale of job no. 59.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: In the two-stage cost allocation process, costs

Q71: Taffy Corporation sells a number of products

Q72: Margery, Inc., which uses a job-costing

Q73: Quatro Products started and finished job no.

Q75: Boxworth and Associates designs relatively small

Q76: The selected data that follow relate

Q77: Finney & Associates is an interior

Q80: Which of the following would not likely

Q81: Discuss the reason for (1) allocating overhead

Q93: Manufacturing overhead is applied to production.

A. Describe

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents