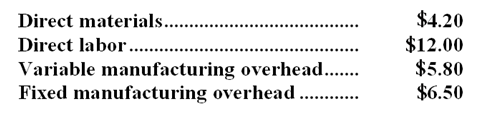

The Rodgers Company makes 27,000 units of a certain component each year for use in one of its products. The cost per unit for the component at this level of activity is as follows:  Rodgers has received an offer from an outside supplier who is willing to provide 27,000 units of this component each year at a price of $25 per component. Assume that direct labor is a variable cost. None of the fixed manufacturing overhead would be avoidable if this component were purchased from the outside supplier.

Rodgers has received an offer from an outside supplier who is willing to provide 27,000 units of this component each year at a price of $25 per component. Assume that direct labor is a variable cost. None of the fixed manufacturing overhead would be avoidable if this component were purchased from the outside supplier.

-Assume that if the component is purchased from the outside supplier,$35,100 of annual fixed manufacturing overhead would be avoided and the facilities now being used to make the component would be rented to another company for $64,800 per year.If Rodgers chooses to buy the component from the outside supplier under these circumstances,then the impact on annual net operating income due to accepting the offer would be:

A) $18,900 decrease

B) $18,900 increase

C) $21,400 decrease

D) $21,400 increase

Correct Answer:

Verified

Q92: The Immanuel Company has just obtained a

Q93: Meacham Company has traditionally made a subcomponent

Q94: Meacham Company has traditionally made a subcomponent

Q95: Mckerchie Inc. manufactures industrial components. One of

Q96: Elhard Company produces a single product. The

Q98: Meltzer Corporation is presently making part O13

Q99: The Rodgers Company makes 27,000 units of

Q100: The Immanuel Company has just obtained a

Q101: Dunford Company produces three products with the

Q149: Bruce Corporation makes four products in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents