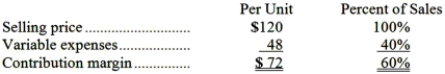

Mowrer Corporation produces and sells a single product. Data concerning that product appear below:  Fixed expenses are $567,000 per month. The company is currently selling 9,000 units per month. The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $11 per unit. In exchange, the sales staff would accept a decrease in their salaries of $84,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 600 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $567,000 per month. The company is currently selling 9,000 units per month. The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $11 per unit. In exchange, the sales staff would accept a decrease in their salaries of $84,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 600 units. What should be the overall effect on the company's monthly net operating income of this change?

A) increase of $77,400

B) increase of $21,600

C) increase of $669,600

D) decrease of $146,400

Correct Answer:

Verified

Q48: Patterson Company's variable expenses are 55% of

Q63: Data concerning Moscowitz Corporation's single product appear

Q66: Perona Corporation produces and sells a single

Q67: Last year,Flynn Company reported a profit of

Q68: A total of 30,000 units were sold

Q69: The contribution margin ratio of Lime Corporation's

Q70: Lone International Corporation's only product sells for

Q71: Rider Company sells a single product.The product

Q74: Smith Company sells a single product at

Q75: Hirt Corporation sells its product for $12

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents