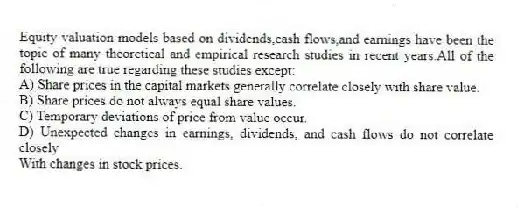

Equity valuation models based on dividends,cash flows,and earnings have been the topic of many theoretical and empirical research studies in recent years.All of the following are true regarding these studies except:

A) Share prices in the capital markets generally correlate closely with share value.

B) Share prices do not always equal share values.

C) Temporary deviations of price from value occur.

D) Unexpected changes in earnings, dividends, and cash flows do not correlate closely

With changes in stock prices.

Correct Answer:

Verified

Q3: Zonk Corp.

The following data pertains to

Q4: Which of the following is not a

Q5: With respect to dividends and priority in

Q6: Zonk Corp.

The following data pertains to

Q7: Zonk Corp.

The following data pertains to

Q9: Returns on systematic risk-free securities (like U.S.Treasury

Q10: Under the cash-flow-based valuation approach,free cash flows

Q11: Investors typically accept a lower risk-adjusted rate

Q12: Zonk Corp.

The following data pertains to

Q13: Firm-specific factors that increase the firm's nondiversifiable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents