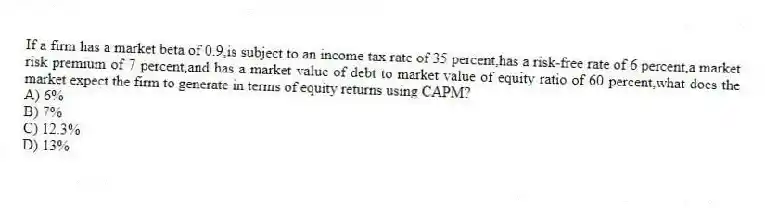

If a firm has a market beta of 0.9,is subject to an income tax rate of 35 percent,has a risk-free rate of 6 percent,a market risk premium of 7 percent,and has a market value of debt to market value of equity ratio of 60 percent,what does the market expect the firm to generate in terms of equity returns using CAPM?

A) 6%

B) 7%

C) 12.3%

D) 13%

Correct Answer:

Verified

Q13: Firm-specific factors that increase the firm's nondiversifiable

Q14: The historical discount rate of the firm

Q15: One rationale for using expected dividends in

Q16: In theory,the value of a share of

Q17: Zonk Corp.

The following data pertains to

Q19: When deriving the equity value of a

Q20: All of the following are steps in

Q21: To determine the appropriate weights to use

Q22: Why are dividends value-relevant to common equity

Q23: Dividends measure the cash that _ ultimately

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents