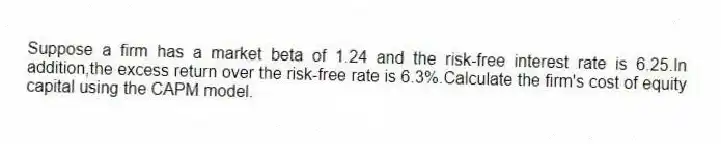

Suppose a firm has a market beta of 1.24 and the risk-free interest rate is 6.25.In addition,the excess return over the risk-free rate is 6.3%.Calculate the firm's cost of equity capital using the CAPM model.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: Normally,valuation methods are designed to produce reliable

Q30: Provide the rationale for using expected dividends

Q31: Explain why analysts and investors use risk-adjusted

Q32: If dividend projections include the effect of

Q33: Implementing a dividend valuation model to determine

Q35: A company with a new

Capital structure will

Q36: One criticism in using the CAPM to

Q37: In what case will using dividends expected

Q38: Identify the types of firm-specific factors that

Q39: The CAPM computes expected rates of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents