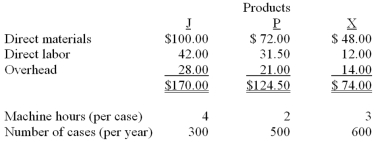

Smelly Perfume Company manufactures and distributes several different products.The company currently uses a plantwide allocation method for allocating overhead at a rate of $7 per direct labor hour.Cindy is the department manager of Department C which produces Products J and P.Department C has $16,200 in traceable overhead.Diane is the department manager of Department D which manufactures Product X.Department D has $11,100 in traceable overhead.The product costs (per case of 24 bottles) and other information are as follows:  If Smelly changes its allocation basis to machine hours,what is the total product cost per case for Product J?

If Smelly changes its allocation basis to machine hours,what is the total product cost per case for Product J?

A) $161.50.

B) $169.30.

C) $182.44.

D) $183.36.

Correct Answer:

Verified

Q22: Smelly Perfume Company manufactures and distributes several

Q23: Cost pools are used with:

Q24: Which of the following statements is (are)false

Q25: Volume-based costing allocates indirect product costs based

Q28: Smelly Perfume Company manufactures and distributes several

Q29: Which one of the following accounts is

Q30: Smelly Perfume Company manufactures and distributes several

Q31: Which of the following measures is used

Q57: Which of the following should not be

Q58: The number of services provided by an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents