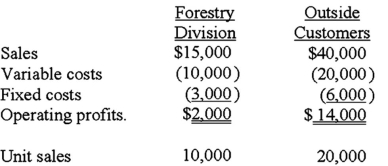

The Blade Division of Axe Company produces hardened steel blades.One-third of Blade's 30,000 unit output is sold to the Forestry Products Division of Axe;the remainder is sold to outside customers.Blades' estimated operating profit for the year is:  The Forestry Division has an opportunity to purchase 10,000 blades of the same quality from an outside supplier on a continuing basis.The purchase price would be $1.25.If the Blade Division is now operating at full capacity and can sell all its units to outside customers at the present selling price,what is the differential cost to Axe of requiring that the blades be made internally and sold to the Forestry Division?

The Forestry Division has an opportunity to purchase 10,000 blades of the same quality from an outside supplier on a continuing basis.The purchase price would be $1.25.If the Blade Division is now operating at full capacity and can sell all its units to outside customers at the present selling price,what is the differential cost to Axe of requiring that the blades be made internally and sold to the Forestry Division?

A) $2,500.

B) $5,000.

C) $7,500.

D) $10,000.

Correct Answer:

Verified

Q25: The CJP Company produces 10,000 units of

Q27: In a decision analysis situation, which one

Q28: The CJP Company produces 10,000 units of

Q30: The following information relates to the Tram

Q32: The MNK Company has gathered the following

Q39: Differential costs are: (CMA adapted)

A) the difference

Q44: Agreement among business competitors to set prices

Q55: The practice of setting prices highest when

Q57: The practice of setting price below cost

Q58: The time from initial research and development

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents