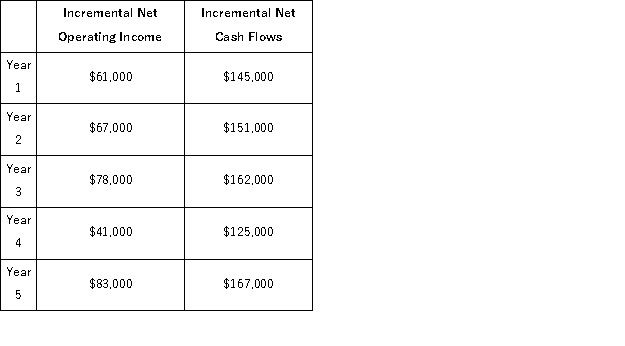

(Ignore income taxes in this problem. ) Baldock Inc.is considering the acquisition of a new machine that costs $420, 000 and has a useful life of 5 years with no salvage value.The incremental net operating income and incremental net cash flows that would be produced by the machine are:  Assume cash flows occur uniformly throughout a year except for the initial investment. If the discount rate is 12%, the net present value of the investment is closest to:

Assume cash flows occur uniformly throughout a year except for the initial investment. If the discount rate is 12%, the net present value of the investment is closest to:

A) $330, 000

B) $539, 365

C) $119, 365

D) $420, 000

Correct Answer:

Verified

Q81: (Ignore income taxes in this problem.) Mercer

Q82: (Ignore income taxes in this problem.) Ataxia

Q88: The net present value of an investment

Q88: (Ignore income taxes in this problem. )Overland

Q91: The Gomez Corporation is considering two projects,

Q93: (Ignore income taxes in this problem.) An

Q94: (Ignore income taxes in this problem.) The

Q95: (Ignore income taxes in this problem.) The

Q98: Bowen Corporation is considering several investment proposals,

Q100: (Ignore income taxes in this problem.) Wombles

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents