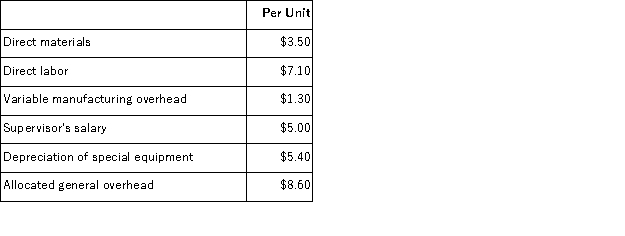

Kampmann Corporation is presently making part Z95 that is used in one of its products.A total of 5, 000 units of this part are produced and used every year.The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to make and sell the part to the company for $24.10 each.If this offer is accepted, the supervisor's salary and all of the variable costs can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.If management decides to buy part Z95 from the outside supplier rather than to continue making the part, what would be the annual impact on the company's overall net operating income?

An outside supplier has offered to make and sell the part to the company for $24.10 each.If this offer is accepted, the supervisor's salary and all of the variable costs can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.If management decides to buy part Z95 from the outside supplier rather than to continue making the part, what would be the annual impact on the company's overall net operating income?

A) Net operating income would decrease by $36, 000 per year.

B) Net operating income would decrease by $34, 000 per year.

C) Net operating income would increase by $34, 000 per year.

D) Net operating income would increase by $36, 000 per year.

Correct Answer:

Verified

Q43: A study has been conducted to determine

Q50: Bosques Corporation has in stock 35,800 kilograms

Q54: A study has been conducted to determine

Q58: Zemlya Corporation currently records $4,000 of depreciation

Q61: Ramon Corporation makes 18, 000 units of

Q63: Oruro Chemical Corporation manufactures a variety of

Q64: Gwinnett Barbecue Sauce Corporation manufactures a specialty

Q65: Tish Corporation produces a part used in

Q67: Wiacek Corporation has received a request for

Q78: Crooks Corporation processes sugar beets in batches

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents