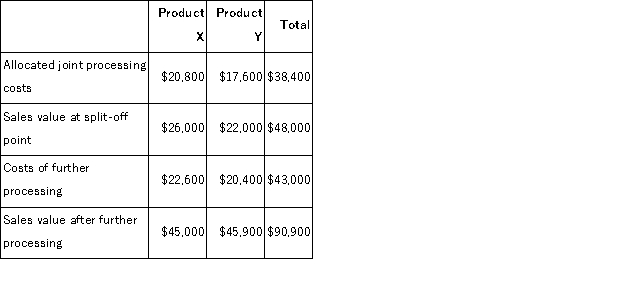

Dowchow Corporation makes two products from a common input.Joint processing costs up to the split-off point total $38, 400 a year.The company allocates these costs to the joint products on the basis of their total sales values at the split-off point.Each product may be sold at the split-off point or processed further.Data concerning these products appear below:  What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?

What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?

A) $22, 400

B) $43, 400

C) $20, 800

D) $45, 000

Correct Answer:

Verified

Q138: The Madison Corporation produces three products with

Q139: Tillison Corporation makes three products that use

Q140: Brown Corporation makes four products in a

Q141: Bulan Inc.makes a range of products.The company's

Q142: Part O43 is used in one of

Q144: Foster Company makes 20, 000 units per

Q145: Tullius Corporation has received a request for

Q146: Dowchow Corporation makes two products from a

Q147: Juett Company produces a single product.The cost

Q148: Costabile Corporation is considering dropping product G41O.Data

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents