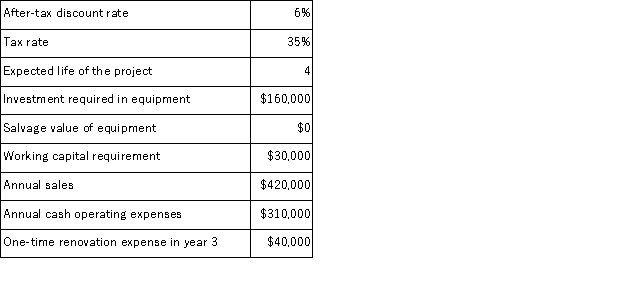

(Appendix 8C) Lucarell Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. The income tax expense in year 3 is:

The company uses straight-line depreciation on all equipment. The income tax expense in year 3 is:

A) $24, 500

B) $14, 000

C) $10, 500

D) $38, 500

Correct Answer:

Verified

Q30: (Appendix 8C)The Moab Corporation had sales of

Q31: (Appendix 8C)Folino Corporation is considering a capital

Q32: (Appendix 8C)Onorato Corporation has provided the following

Q33: (Appendix 8C)A company needs an increase in

Q34: (Appendix 8C)Santistevan Corporation has provided the following

Q36: (Appendix 8C)Folino Corporation is considering a capital

Q37: (Appendix 8C)Leamon Corporation is considering a capital

Q38: (Appendix 8C)Lasater Corporation has provided the following

Q39: (Appendix 8C)Gutshall Corporation is considering a capital

Q40: (Appendix 8C)Pulkkinen Corporation has provided the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents