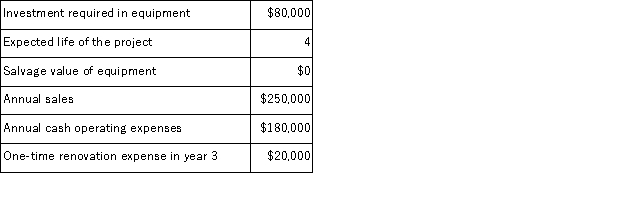

(Appendix 8C) Credit Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 15%.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 2 is:

The company's income tax rate is 30% and its after-tax discount rate is 15%.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 2 is:

A) $15, 000

B) $6, 000

C) $9, 000

D) $21, 000

Correct Answer:

Verified

Q63: (Appendix 8C)Foucault Corporation has provided the following

Q64: (Appendix 8C)Foucault Corporation has provided the following

Q65: (Appendix 8C)Skolfield Corporation is considering a capital

Q66: (Appendix 8C)Skolfield Corporation is considering a capital

Q67: (Appendix 8C)Trammel Corporation is considering a capital

Q69: (Appendix 8C)Shinabery Corporation has provided the following

Q70: (Appendix 8C)Foucault Corporation has provided the following

Q71: (Appendix 8C)Credit Corporation has provided the following

Q72: (Appendix 8C)Credit Corporation has provided the following

Q73: (Appendix 8C)Shinabery Corporation has provided the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents