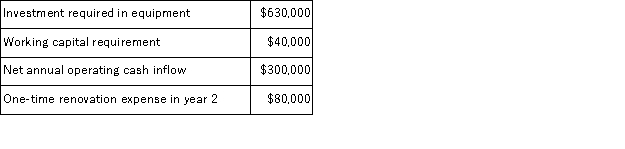

(Appendix 8C)Mota Corporation has provided the following information concerning a capital budgeting project:  The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $210, 000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The income tax rate is 35%.The after-tax discount rate is 15%.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $210, 000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The income tax rate is 35%.The after-tax discount rate is 15%.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project.Show your work!

Correct Answer:

Verified

Q120: (Appendix 8C)Amel Corporation has provided the following

Q121: (Appendix 8C)Revello Corporation is considering a capital

Q122: (Appendix 8C)Menghini Corporation is considering a capital

Q123: (Appendix 8C)Corchado Corporation is considering a capital

Q124: (Appendix 8C)Deninno Corporation is considering a capital

Q126: (Appendix 8C)Gloden Corporation has provided the following

Q127: (Appendix 8C)Flippo Corporation is considering a capital

Q128: (Appendix 8C)Molima Corporation has provided the following

Q129: (Appendix 8C)Beecroft Corporation is considering a capital

Q130: (Appendix 8C)Shaddock Corporation is considering a capital

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents